Choosing between Lekki vs Ajah vs Ibeju-Lekki is one of the most critical decisions facing Lagos real estate investors in 2026. Whether you’re a member of the Nigerian Diaspora planning to buy property in Lagos or a local investor seeking maximum returns, understanding the distinct advantages and trade-offs of each location determines your investment success.

As a SCUML-registered real estate brokerage (ATLAS REAL ESTATE BROKER LTD), we’ve facilitated over 50+ property transactions across all three corridors, giving us unique insights into what makes each area special. The Lekki vs Ajah vs Ibeju-Lekki debate isn’t about finding the “best” location—it’s about matching the right area to your specific investment goals, budget, timeline, and lifestyle requirements.

This comprehensive 2026 comparison guide examines property prices, infrastructure development, investment returns, security considerations, lifestyle amenities, and future appreciation potential across all three locations in the Lekki vs Ajah vs Ibeju-Lekki decision. By the end of this analysis, you’ll have a clear framework for making your Lekki vs Ajah vs Ibeju-Lekki decision with confidence. Ready to determine which area deserves your investment? Book a consultation with our expert team to discuss your specific situation and get personalized guidance on your Lekki vs Ajah vs Ibeju-Lekki choice.

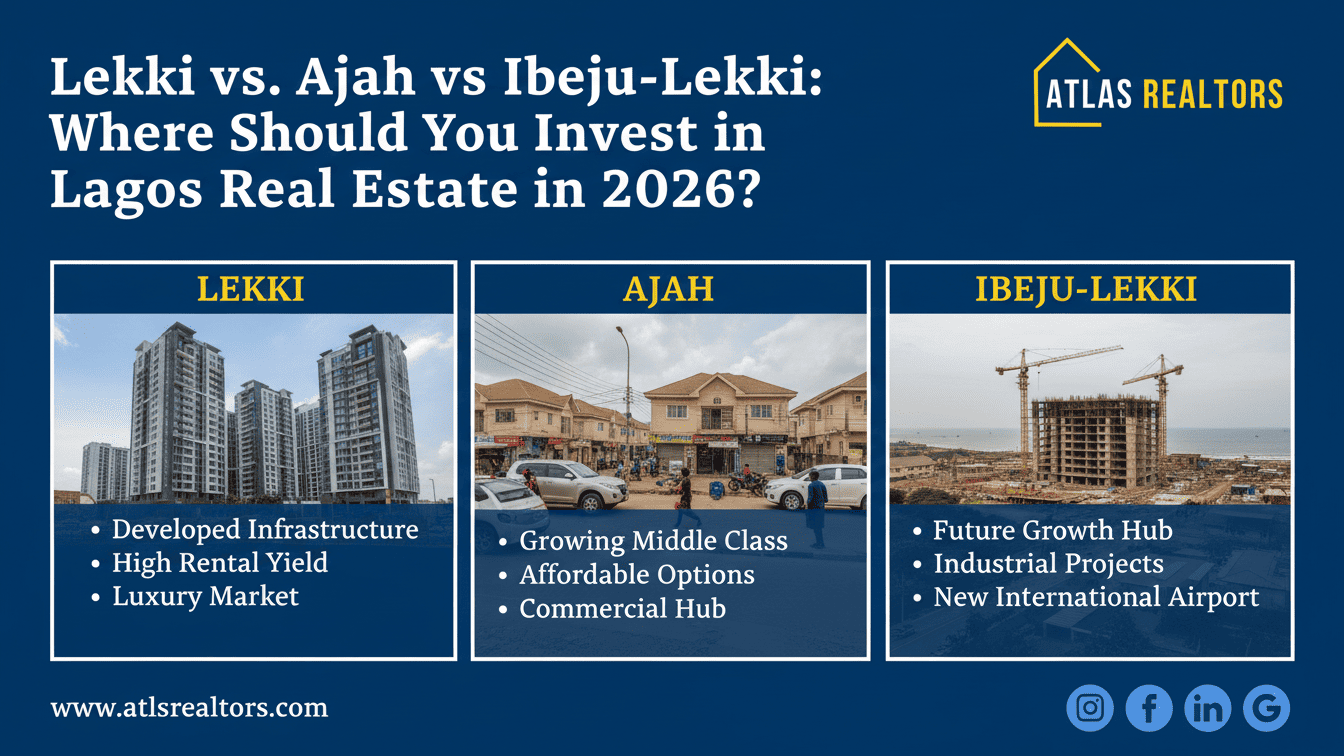

Quick Comparison: Lekki vs Ajah vs Ibeju-Lekki (2026 Overview)

Before diving into detailed analysis, here’s a snapshot comparing Lekki vs Ajah vs Ibeju-Lekki across key investment metrics:

| Criteria | Lekki (Phase 1 & 2) | Ajah | Ibeju-Lekki |

|---|---|---|---|

| Land Price Range | ₦800K – ₦2.5M per sqm | ₦150K – ₦600K per sqm | ₦15K – ₦90K per sqm |

| Entry Barrier | High (₦400M – ₦1.5B) | Medium (₦20M – ₦300M) | Low (₦8M – ₦45M) |

| Infrastructure | Fully Developed | Developing (70%) | Emerging (30–40%) |

| ROI Timeline | 5–7 years | 3–5 years | 7–10 years |

| Annual Appreciation | 8–12% | 18–30% | 35–60% |

| Lifestyle Rating | Premium / Luxury | Mid-Market / Family | Basic / Future-Oriented |

| Security Level | Excellent | Good | Moderate |

| Title Availability | C of O Common | Mixed Titles | Mainly Excision |

| Best For | Luxury / Immediate | Balanced / Mid-Budget | Land Banking / High ROI |

Understanding the Lekki vs Ajah vs Ibeju-Lekki Geography

Location Context and Accessibility

The Lekki vs Ajah vs Ibeju-Lekki comparison begins with understanding their geographic positioning along the Lekki-Epe Expressway corridor:

Lekki (Phase 1 & Phase 2):

- Distance from VI/Ikoyi: 15-25 minutes (off-peak)

- Expressway Access: Direct, multiple entry points

- Coordinates: Lekki Phase 1 starts approximately 10km from Victoria Island

- Key Landmarks: Lekki Conservation Centre, Elegushi Beach, Circle Mall

Ajah:

- Distance from VI/Ikoyi: 35-50 minutes (off-peak)

- Expressway Access: Direct (Ajah Roundabout, Abraham Adesanya)

- Coordinates: Begins approximately 25km from Victoria Island

- Key Landmarks: Novare Mall Shoprite, Atican Beach, Abraham Adesanya Estate

Ibeju-Lekki:

- Distance from VI/Ikoyi: 60-90 minutes (off-peak)

- Expressway Access: Via Lekki-Epe Expressway extension

- Coordinates: Begins approximately 50km from Victoria Island

- Key Landmarks: Dangote Refinery, Lekki Free Trade Zone, Lekki Deep Seaport

According to Lagos State Bureau of Statistics, commute times have improved 20-30% since 2023 due to ongoing road rehabilitation. However, the Lekki vs Ajah vs Ibeju-Lekki accessibility comparison remains significant for daily commuters versus long-term investors.

For diaspora buyers working remotely or planning retirement homes, accessibility may matter less than appreciation potential in the Lekki vs Ajah vs Ibeju-Lekki evaluation. Our team can help you weight these factors appropriately when making your Lekki vs Ajah vs Ibeju-Lekki choice—book a consultation to discuss your specific needs. Also review our guide on land scams in Lekki to protect yourself across all Lekki vs Ajah vs Ibeju-Lekki locations.

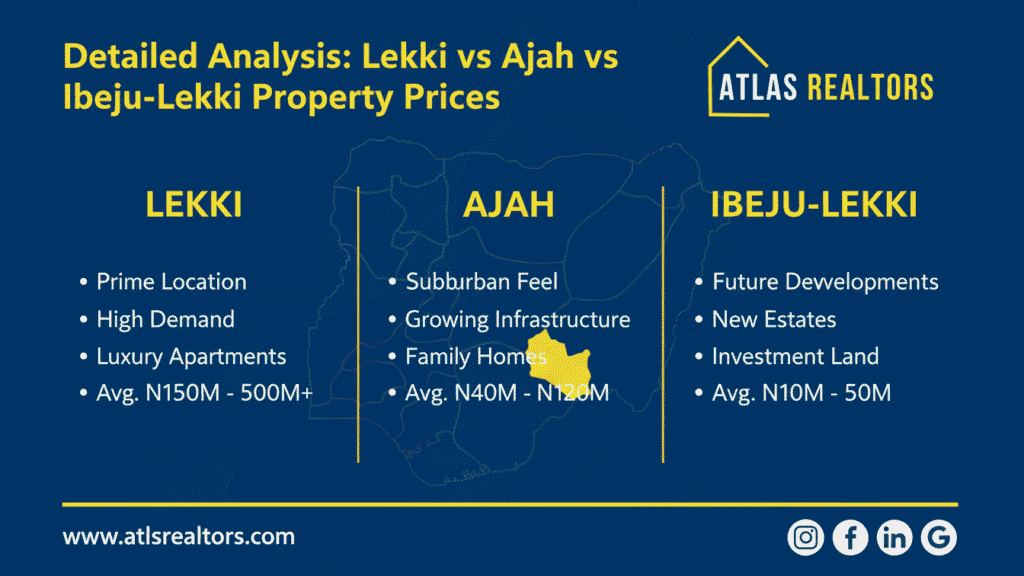

Detailed Analysis: Lekki vs Ajah vs Ibeju-Lekki Property Prices

Current Market Prices (January 2026)

Understanding pricing differences is central to the Lekki vs Ajah vs Ibeju-Lekki investment decision:

Lekki Property Prices

Lekki Phase 1:

- Residential Land: ₦1.2M – ₦2.5M per sqm

- 500sqm Plot: ₦600M – ₦1.25B

- Commercial Land: ₦2M – ₦3.5M per sqm

- Built Homes (3-bedroom): ₦200M – ₦500M

Lekki Phase 2:

- Residential Land: ₦800K – ₦1.5M per sqm

- 500sqm Plot: ₦400M – ₦750M

- Commercial Land: ₦1.2M – ₦2M per sqm

- Built Homes (3-bedroom): ₦120M – ₦280M

For comprehensive pricing analysis, see our detailed guide on land prices in Lekki Lagos.

Ajah Property Prices

Abraham Adesanya / Ado Road:

- Residential Land: ₦200K – ₦600K per sqm

- 500sqm Plot: ₦100M – ₦300M

- Built Homes (3-bedroom): ₦50M – ₦120M (as reported by Nigeria Property Centre)

Sangotedo / Awoyaya:

- Residential Land: ₦40K – ₦120K per sqm

- 500sqm Plot: ₦20M – ₦60M

- Built Homes (3-bedroom): ₦35M – ₦80M

Lakowe:

- Estate Land: ₦100K – ₦300K per sqm

- 500sqm Plot: ₦50M – ₦150M (in gated estates with amenities)

Ibeju-Lekki Property Prices

Eleranigbe:

- Residential Land: ₦30K – ₦90K per sqm

- 500sqm Plot: ₦15M – ₦45M

- Raw Land Appreciation: 35-50% annually (2023-2025 average)

Bogije:

- Residential Land: ₦15K – ₦50K per sqm

- 500sqm Plot: ₦8M – ₦25M

- High ROI Potential: 40-60% annually in strategic locations

Beechwood Estate / Serviced Plots:

- Estate Land: ₦90K – ₦180K per sqm

- 450-500sqm Plot: ₦45M – ₦90M

According to research from PropertyPro Nigeria, the Lekki vs Ajah vs Ibeju-Lekki price differential creates distinct investment opportunities: Lekki offers stability and prestige, Ajah provides balance, while Ibeju-Lekki delivers maximum appreciation potential. Understanding these price dynamics is fundamental to making the right Lekki vs Ajah vs Ibeju-Lekki choice.

Our real estate broker in Lekki Lagos page provides additional context on pricing dynamics across all three corridors, and our team specializes in helping investors navigate the Lekki vs Ajah vs Ibeju-Lekki decision with data-driven analysis.

Investment Insight: Your budget determines your starting point in the Lekki vs Ajah vs Ibeju-Lekki decision. With ₦20-50M, Ajah or Ibeju-Lekki are realistic. With ₦400M+, Lekki becomes accessible. For detailed pricing breakdowns across all three locations in the Lekki vs Ajah vs Ibeju-Lekki spectrum, review our comprehensive guide on land prices in Lekki Lagos. For personalized budget analysis, book a consultation with our financial planning team.

Infrastructure Development: Lekki vs Ajah vs Ibeju-Lekki (2026 Status)

Current Infrastructure Comparison

Infrastructure quality dramatically impacts both lifestyle and investment returns in the Lekki vs Ajah vs Ibeju-Lekki comparison:

Lekki Infrastructure (95% Complete)

Road Network:

- Fully tarred internal roads with drainage systems

- Multiple expressway access points

- Lekki-Ikoyi Link Bridge connectivity

- Traffic management systems in place

Utilities:

- 24/7 electricity in most estates (private generation)

- IBEDC grid connection with reliable supply

- Fiber optic internet (multiple providers)

- Treated water supply systems

Amenities:

- International schools (Corona, Greensprings, Chrisland)

- Premium hospitals (Reddington, Grandville)

- Shopping malls (Circle Mall, Novare Lekki)

- Fine dining, entertainment, beach clubs

According to Lands of Nigeria analysis, Lekki’s infrastructure maturity makes it ideal for immediate occupation but limits dramatic appreciation potential compared to Ajah or Ibeju-Lekki.

Ajah Infrastructure (70% Complete – Rapidly Improving)

Road Network:

- Lekki-Epe Expressway (rehabilitated 2025-2026)

- Ajah Flyover Bridge (completed 2023) – reduced congestion by 40%

- Internal estate roads (80% tarred in major developments)

- VGC-Regional Road improvements ongoing

Utilities:

- Electricity improving (IBEDC + estate generation)

- Estate-level infrastructure in gated communities

- Internet penetration expanding

- Water supply via estate boreholes

Amenities:

- Novare Mall Shoprite (major commercial hub)

- Good schools (Greensprings, Chrisland branches)

- Mid-market shopping and dining

- Atican Beach, local markets

The Lekki vs Ajah vs Ibeju-Lekki infrastructure comparison shows Ajah in a “sweet spot”—developed enough for comfortable living, but with enough room for appreciation as improvements continue.

Critical Development: The Fourth Mainland Bridge construction (active as of January 2026) will dramatically improve Ajah’s connectivity by 2028-2029, positioning it for 40-60% appreciation according to The Meridian Luxury Park analysis.

Ibeju-Lekki Infrastructure (35% Complete – Major Projects Underway)

Major Infrastructure Catalysts:

- Lagos-Calabar Coastal Highway: Phase 1 (47.47km) nearing completion Q1-Q2 2026

- Dangote Refinery: Fully operational since 2023, employing 30,000+

- Lekki Deep Seaport: Operational, processing 1.2M TEUs annually

- Lekki Free Trade Zone: 180+ companies, $2.5B investments

- Proposed Lekki International Airport: Construction ongoing, targeted 2027-2028 opening

Current Infrastructure Status:

- Main Lekki-Epe Expressway access (good condition)

- Interior roads: 40% tarred (estate-dependent)

- Electricity: Limited IBEDC, mostly estate generation

- Water: Borehole-dependent

- Internet: Expanding but inconsistent

According to Nigerian Institution of Estate Surveyors and Valuers (NIESV) research, properties within 3km of major infrastructure (Dangote, Seaport, Coastal Highway) are appreciating 50-70% annually as of 2025-2026.

The Lekki vs Ajah vs Ibeju-Lekki infrastructure analysis reveals a clear trade-off: immediate comfort versus future appreciation. Ibeju-Lekki requires patience but offers the highest upside, while Lekki provides immediate gratification at premium prices.

To understand how infrastructure timelines impact your specific investment window, book a consultation with our infrastructure analysis specialists.

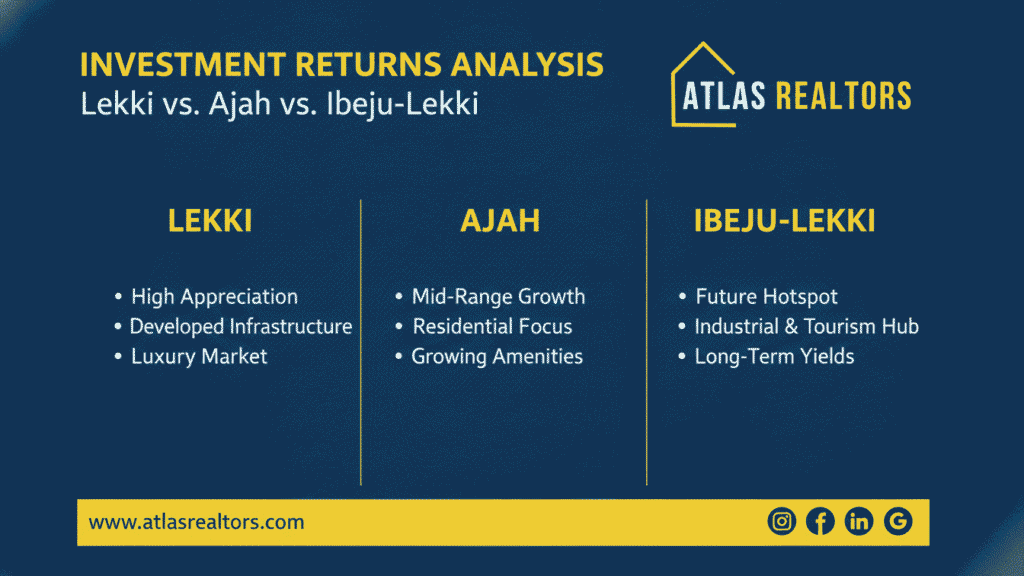

Investment Returns Analysis: Lekki vs Ajah vs Ibeju-Lekki

Historical Appreciation Patterns (2020-2026)

Real-world data shows dramatic differences in the Lekki vs Ajah vs Ibeju-Lekki investment performance across the entire corridor. These appreciation patterns are crucial for understanding which location in the Lekki vs Ajah vs Ibeju-Lekki comparison best matches your investment timeline. For micro-location analysis showing the highest-performing areas within each corridor of the Lekki vs Ajah vs Ibeju-Lekki spectrum, explore our detailed guide on the best areas to invest in Lekki:

Lekki Appreciation (2020-2026)

Lekki Phase 1:

- 2020 Average: ₦800K per sqm

- 2026 Average: ₦1.5M per sqm

- Total Appreciation: 87.5% (6 years)

- Annual Average: ~14.6%

Lekki Phase 2:

- 2020 Average: ₦500K per sqm

- 2026 Average: ₦1.1M per sqm

- Total Appreciation: 120% (6 years)

- Annual Average: ~20%

ROI Profile: Stable, moderate appreciation with low volatility. Best for wealth preservation and steady growth.

Ajah Appreciation (2020-2026)

Abraham Adesanya:

- 2020 Average: ₦150K per sqm

- 2026 Average: ₦400K per sqm

- Total Appreciation: 167% (6 years)

- Annual Average: ~27.8%

Sangotedo:

- 2020 Average: ₦20K per sqm

- 2026 Average: ₦80K per sqm

- Total Appreciation: 300% (6 years)

- Annual Average: ~50%

ROI Profile: High growth with moderate volatility. Excellent for mid-term (3-5 year) investors seeking balance.

According to Victoria Crest Homes analysis, Ajah’s infrastructure improvements (Fourth Mainland Bridge, road rehabilitations) position it for continued 20-35% annual appreciation through 2028-2030.

Ibeju-Lekki Appreciation (2020-2026)

Eleranigbe:

- 2020 Average: ₦8K per sqm

- 2026 Average: ₦60K per sqm

- Total Appreciation: 650% (6 years)

- Annual Average: ~108%

Bogije:

- 2020 Average: ₦5K per sqm

- 2026 Average: ₦30K per sqm

- Total Appreciation: 500% (6 years)

- Annual Average: ~83%

ROI Profile: Explosive growth with higher volatility. Ideal for patient, long-term (7-10 year) investors comfortable with frontier markets.

According to Shalom Park Estate data, Ibeju-Lekki properties within 5km of the Dangote Refinery or Lekki Deep Seaport have outperformed even these averages, with some micro-locations seeing 800-1000% appreciation since 2020.

Real Client Case Studies: Lekki vs Ajah vs Ibeju-Lekki

Case Study 1: Lekki Phase 2 Investment (2022-2026)

- Client: UK-Based Accountant

- Purchase: 600sqm plot, Lekki Phase 2

- 2022 Price: ₦480M (₦800K per sqm)

- 2026 Value: ₦720M (₦1.2M per sqm)

- Return: 50% (4 years) = 12.5% annually

- Strategy: Built 4-bedroom duplex, now renting at ₦8M/year (6.6% yield)

Case Study 2: Ajah/Sangotedo Investment (2023-2026)

- Client: US-Based Software Engineer

- Purchase: 500sqm plot, Sangotedo

- 2023 Price: ₦24M (₦48K per sqm)

- 2026 Value: ₦60M (₦120K per sqm)

- Return: 150% (3 years) = 50% annually

- Strategy: Land banking, planning construction 2027

Case Study 3: Ibeju-Lekki Investment (2021-2026)

- Client: Canadian Diaspora Investor

- Purchase: 1,000sqm plot, Eleranigbe

- 2021 Price: ₦15M (₦15K per sqm)

- 2026 Value: ₦65M (₦65K per sqm)

- Return: 333% (5 years) = 66.6% annually

- Strategy: Land banking, awaiting infrastructure completion

These real cases from ATLAS REAL ESTATE BROKER LTD’s portfolio demonstrate the distinct Lekki vs Ajah vs Ibeju-Lekki return profiles. Each client chose the location matching their timeline, risk tolerance, and investment goals.

Want to explore which investment profile matches your situation? Book a consultation for personalized ROI projections based on your specific parameters.

For additional context on avoiding investment pitfalls, read our guide on land scams in Lekki and learn about our comprehensive land document verification process.

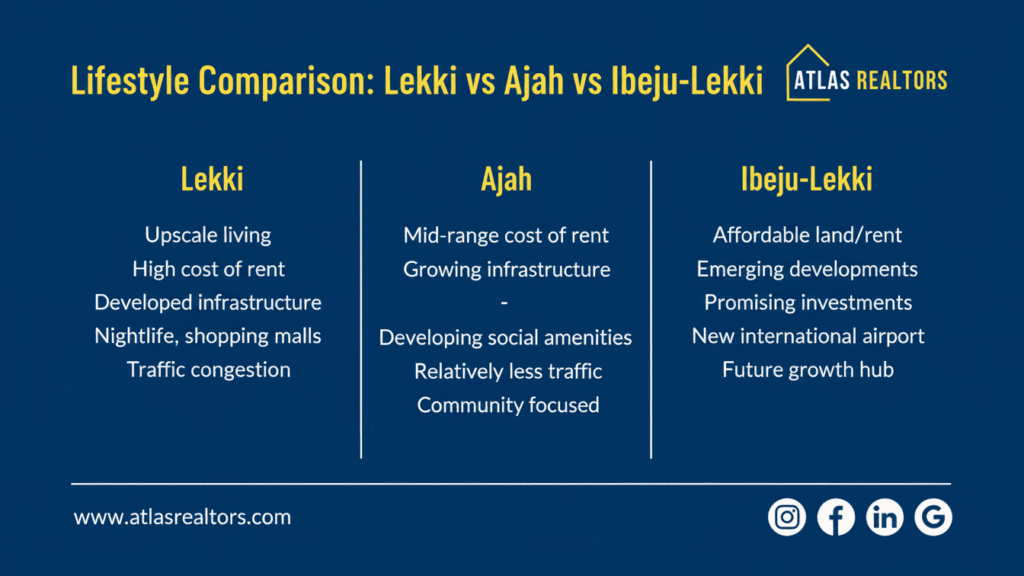

Lifestyle Comparison: Lekki vs Ajah vs Ibeju-Lekki

Daily Living Experience

Beyond investment returns, the Lekki vs Ajah vs Ibeju-Lekki decision significantly impacts your quality of life:

Lekki Lifestyle (Premium/Cosmopolitan)

Social Scene:

- Upscale restaurants (Shiro, Circa, Nok by Alara)

- Beach clubs (Elegushi, Landmark, La Cabana)

- Vibrant nightlife (Quilox, Cubana)

- Art galleries and cultural events

- Expatriate community

Education:

- Top international schools within 10-15 minutes

- British, American, IB curricula available

- University proximity (Pan-Atlantic University)

Healthcare:

- Premium hospitals (Reddington, Grandville)

- Specialist medical centers

- 24/7 emergency services

Shopping:

- Circle Mall, The Palms Lekki

- High-end boutiques on Admiralty Way

- International grocery stores (Shoprite, Spar)

Traffic Reality: Heavy congestion during peak hours (7-10am, 5-8pm). According to The Africanvestor rental analysis, professionals working in VI/Ikoyi often spend 60-90 minutes in traffic daily.

Best For: High-net-worth individuals, expatriates, professionals prioritizing lifestyle over ROI, families wanting premium education.

Ajah Lifestyle (Family-Friendly/Balanced)

Social Scene:

- Growing restaurant scene (mid-market)

- Atican Beach, local beach clubs

- Novare Mall for shopping and cinema

- Community-oriented estates

- Mix of local and expatriate residents

Education:

- Good schools (Greensprings, Chrisland branches)

- International school options within 15-20 minutes

- Growing number of quality private schools

Healthcare:

- Mid-tier hospitals and clinics

- Improving medical infrastructure

- 30-40 minutes to premium Lekki hospitals

Shopping:

- Novare Mall Shoprite (major hub)

- Local markets for daily needs

- Growing commercial centers

Traffic Reality: Moderate congestion, significantly improved since Ajah Flyover completion. According to Installment Homes analysis, commute times reduced 40% in 2023-2024.

Best For: Middle-income families, young professionals, investors seeking lifestyle-ROI balance, diaspora building family homes.

Ibeju-Lekki Lifestyle (Basic/Future-Oriented)

Social Scene:

- Limited social infrastructure currently

- La Campagne Tropicana Beach Resort (major attraction)

- Eleko Beach access

- Emerging local restaurants

- Pioneer community atmosphere

Education:

- Pan-Atlantic University (major presence)

- Limited international school options (20-30km to Lekki schools)

- Growing but basic private school infrastructure

Healthcare:

- Basic clinics and pharmacies

- 45-60 minutes to premium hospitals

- Estate-level health facilities in gated communities

Shopping:

- Limited commercial infrastructure

- Local markets for basics

- 30-45 minutes to major malls

Traffic Reality: Light traffic currently, though infrastructure construction can cause delays. As the area develops, expect increasing congestion.

Best For: Long-term investors prioritizing ROI over lifestyle, land bankers, remote workers, retirees planning 5-10 year timelines.

The Lekki vs Ajah vs Ibeju-Lekki lifestyle comparison reveals a clear hierarchy: Lekki offers everything now at premium cost, Ajah provides good balance with growth potential, while Ibeju-Lekki requires sacrificing current amenities for future gains.

For families considering educational priorities, our team can provide school-specific location guidance—book a consultation to discuss your children’s educational needs alongside investment goals.

Security Analysis: Lekki vs Ajah vs Ibeju-Lekki

Safety Considerations

Security remains a critical factor in the Lekki vs Ajah vs Ibeju-Lekki investment decision:

Lekki Security Profile

Strengths:

- Well-established estate security systems

- Strong police presence

- Community vigilante groups

- CCTV surveillance in major areas

- Controlled access points in gated estates

Concerns:

- Traffic-related crimes (petty theft at gridlock)

- Occasional break-ins outside secure estates

- High-value target perception

Rating: Excellent (9/10) – Industry-leading security infrastructure

Ajah Security Profile

Strengths:

- Improving significantly since 2023

- Modern estates with security protocols

- Controlled entry points in gated communities

- Growing police presence

- Community security initiatives

Concerns:

- Variable security outside gated estates

- Some inner communities less secure

- Past reputation (improving rapidly)

Rating: Good (7/10) – Substantial improvements, estate-dependent

According to Victoria Crest Homes security analysis, Ajah estates like Citadel Views now match Lekki security standards with private guards, perimeter fencing, and 24/7 surveillance.

Ibeju-Lekki Security Profile

Strengths:

- Low crime rates (sparse population currently)

- Estate-level security in gated communities

- Community cohesion among pioneers

- Strategic presence of major corporations (Dangote security)

Concerns:

- Limited police infrastructure

- Remote areas more vulnerable

- Developing security frameworks

- Longer emergency response times

Rating: Moderate (6/10) – Improving as development increases, heavily estate-dependent

Security Recommendation: In the Lekki vs Ajah vs Ibeju-Lekki security comparison, invest in gated estates regardless of location. This equalizes security standards significantly. Our real estate broker in Lekki Lagos team vets all recommended properties for security infrastructure.

To ensure your property meets security standards, review our due diligence process which includes security assessment as a key verification step.

Title Documentation: Lekki vs Ajah vs Ibeju-Lekki

Land Title Availability and Security

Title quality varies significantly in the Lekki vs Ajah vs Ibeju-Lekki comparison, directly impacting investment security:

Lekki Title Profile

Common Title Types:

- Certificate of Occupancy (C of O) with Governor’s Consent: 60%

- Government Excision awaiting C of O: 30%

- Registered Survey with family/community title: 10%

Title Security: Excellent – Most properties have perfected titles or clear path to perfection

Challenges: Minimal – Established legal frameworks

Verification Timeline: 14-21 days average

Ajah Title Profile

Common Title Types:

- Government Excision: 50%

- Certificate of Occupancy: 25%

- Registered Survey with family/community title: 20%

- Survey plan only: 5%

Title Security: Good to Moderate – More variable than Lekki

Challenges: Some areas still transitioning from traditional to government titles

Verification Timeline: 21-30 days average

According to Lagos State Land Registry data, Ajah saw a 45% increase in excision gazettes between 2023-2025, improving title security substantially.

Ibeju-Lekki Title Profile

Common Title Types:

- Government Excision: 40%

- Registered Survey with family/community title: 35%

- Certificate of Occupancy (in estates): 15%

- Survey plan only: 10%

Title Security: Moderate to Variable – Requires rigorous due diligence

Challenges: Traditional landowner issues (Omo Onile), ongoing title formalization

Verification Timeline: 30-45 days average

Critical Warning: According to PropertyPro analysis, approximately 18-22% of Ibeju-Lekki land sales face ownership disputes within 5 years. This makes professional verification absolutely essential.

The Lekki vs Ajah vs Ibeju-Lekki title comparison reveals that lower entry costs in Ibeju-Lekki come with higher due diligence requirements. This is why ATLAS REAL ESTATE BROKER LTD’s comprehensive verification process has saved clients ₦430M+ in prevented losses from disputed purchases.

Never skip title verification, regardless of location. Book a consultation to learn about our 15-point due diligence process that protects your investment.

For detailed guidance on title types and verification procedures, read our comprehensive guide on how to verify land documents in Lagos.

Making Your Decision: Lekki vs Ajah vs Ibeju-Lekki

Decision Framework by Investor Profile

Use this framework to determine which location in the Lekki vs Ajah vs Ibeju-Lekki comparison matches your profile:

Choose Lekki If You:

✅ Have a budget of ₦400M+ for land or ₦150M+ for built homes

✅ Prioritize immediate lifestyle amenities over maximum ROI

✅ Plan to occupy property within 1-2 years

✅ Value proximity to business districts (VI/Ikoyi)

✅ Want premium international schools nearby

✅ Prefer established infrastructure and predictable environment

✅ Are building luxury primary residence

✅ Accept 8-15% annual appreciation as satisfactory returns

✅ Want maximum title security with minimal due diligence risk

Investment Horizon: 5-7 years minimum

Risk Profile: Conservative to Moderate

Expected ROI: 50-100% over 5-7 years

Choose Ajah If You:

✅ Have a budget of ₦20M-300M

✅ Want balance between lifestyle and appreciation

✅ Plan to occupy or develop within 2-4 years

✅ Seek 20-35% annual appreciation potential

✅ Need good (not premium) schools and amenities

✅ Are comfortable with developing (not fully developed) infrastructure

✅ Want family-friendly environment with community feel

✅ Can handle moderate due diligence requirements

✅ Appreciate Fourth Mainland Bridge future impact

Investment Horizon: 3-5 years optimal

Risk Profile: Moderate

Expected ROI: 100-200% over 3-5 years

Ajah Sweet Spot: This is often the ideal compromise in the Lekki vs Ajah vs Ibeju-Lekki comparison for middle-income diaspora investors. When evaluating the Lekki vs Ajah vs Ibeju-Lekki options, Ajah consistently emerges as the balanced choice that satisfies both lifestyle and ROI requirements for most buyers navigating the Lekki vs Ajah vs Ibeju-Lekki decision.

Choose Ibeju-Lekki If You:

✅ Have a budget of ₦8M-45M (or larger for commercial)

✅ Prioritize maximum long-term ROI over lifestyle

✅ Can wait 7-10 years for full infrastructure development

✅ Are land banking for future development

✅ Don’t need immediate occupation

✅ Understand and accept frontier market risks

✅ Can conduct rigorous due diligence or work with professional brokers

✅ Seek 35-60%+ annual appreciation

✅ Are remote workers or retirees with flexible timelines

Investment Horizon: 7-10 years minimum

Risk Profile: Moderate to Aggressive

Expected ROI: 300-800% over 7-10 years

Ibeju-Lekki Advantage: For patient investors in the Lekki vs Ajah vs Ibeju-Lekki comparison, this offers the highest upside with proper location selection. To identify the specific neighborhoods within Ibeju-Lekki that offer maximum ROI in your Lekki vs Ajah vs Ibeju-Lekki evaluation, consult our comprehensive guide on the best areas to invest in Lekki which analyzes high-growth micro-locations.

Hybrid Strategy: Why Not All Three?

Many sophisticated investors in the Lekki vs Ajah vs Ibeju-Lekki comparison don’t choose one location exclusively:

Portfolio Approach:

- 40% Lekki Phase 2: Stability anchor, immediate rental income potential

- 30% Ajah: Mid-term growth, balanced risk-reward

- 30% Ibeju-Lekki: Long-term explosive growth

This diversification strategy balances the Lekki vs Ajah vs Ibeju-Lekki trade-offs across your portfolio rather than putting all capital in one location.

Our investment advisory team can help you construct an optimal location-diversified portfolio based on your total capital availability. Book a consultation to explore multi-location strategies that maximize returns across the Lekki vs Ajah vs Ibeju-Lekki spectrum.

For additional investment location insights on specific neighborhoods within each area of the Lekki vs Ajah vs Ibeju-Lekki comparison, explore our detailed analysis on the best areas to invest in Lekki which covers high-ROI micro-locations within each corridor.

2026-2030 Projections: Future of Lekki vs Ajah vs Ibeju-Lekki

Infrastructure Milestones and Market Impact

Understanding upcoming developments helps project the Lekki vs Ajah vs Ibeju-Lekki landscape through 2030:

Lekki Projections (2026-2030)

Expected Developments:

- Eko Atlantic completion phases

- Blue Line Rail extension consideration

- Additional commercial developments

- Beach area revitalization projects

Price Projections:

- Lekki Phase 1: ₦2M – ₦3.5M per sqm by 2030 (8-12% annual appreciation)

- Lekki Phase 2: ₦1.5M – ₦2.5M per sqm by 2030 (10-15% annual appreciation)

Market Maturity: Approaching saturation, but remains premium destination

Ajah Projections (2026-2030)

Expected Developments:

- Fourth Mainland Bridge completion (2028-2029) – GAME CHANGER

- VGC-Regional Road completion

- Abraham Adesanya corridor commercial boom

- Increased estate development

Price Projections:

- Abraham Adesanya: ₦800K – ₦1.2M per sqm by 2030 (20-30% annual appreciation)

- Sangotedo/Awoyaya: ₦200K – ₦400K per sqm by 2030 (25-40% annual appreciation)

Market Impact: According to Installment Homes projections, the Fourth Mainland Bridge will trigger Ajah’s “Lekki-fication” – transforming it into a premium mid-market destination by 2030.

The Lekki vs Ajah vs Ibeju-Lekki competition shifts significantly post-2028 as Ajah closes the infrastructure gap with Lekki.

Ibeju-Lekki Projections (2026-2030)

Expected Developments:

- Lagos-Calabar Coastal Highway full completion (Phase 1: 2026, subsequent phases: 2027-2029)

- Lekki International Airport opening (2027-2028)

- Lekki Free Trade Zone expansion to 50,000+ employees

- Dangote Refinery ecosystem maturation

- Smart City development initiatives

Price Projections:

- Eleranigbe: ₦150K – ₦300K per sqm by 2030 (30-50% annual appreciation)

- Coastal Highway corridor: ₦200K – ₦400K per sqm by 2030 (35-60% annual appreciation)

Market Transformation: According to Adron Homes analysis, Ibeju-Lekki transitions from “frontier investment” to “established growth market” between 2027-2030 as infrastructure completes.

The Lekki vs Ajah vs Ibeju-Lekki hierarchy in 2030 will look vastly different than 2026, with Ajah and Ibeju-Lekki narrowing lifestyle gaps while maintaining price advantages.

2030 Prediction: Properties purchased in strategic Ibeju-Lekki locations in 2026 will likely match current Ajah pricing by 2030-2032, representing 500-700% appreciation for early investors.

For detailed current pricing that forms the baseline for these projections, review our comprehensive guide on land prices in Lekki Lagos.

Common Mistakes in the Lekki vs Ajah vs Ibeju-Lekki Decision

Avoid These Critical Errors

Based on ATLAS REAL ESTATE BROKER LTD’s experience with 200+ transactions, here are the most common mistakes investors make in the Lekki vs Ajah vs Ibeju-Lekki comparison:

Mistake #1: Choosing Based on Price Alone

The Error: “Ibeju-Lekki is cheapest, so I’ll buy there.”

The Reality: A ₦10M plot in remote Bogije might never appreciate if it’s 10km from infrastructure in a flood-prone area with disputed title.

The Solution: Evaluate location quality within each area using micro-location analysis. Our real estate broker in Lekki Lagos team assesses 15+ factors beyond price including infrastructure proximity, title quality, access roads, and flood risk.

Case Example: Two Ibeju-Lekki plots both priced at ₦15M in 2023:

- Plot A (near Dangote, good access): Now worth ₦45M (200% gain)

- Plot B (interior, poor access): Now worth ₦18M (20% gain)

Location quality matters as much as location choice in the Lekki vs Ajah vs Ibeju-Lekki decision.

Mistake #2: Ignoring Your Timeline

The Error: Buying Ibeju-Lekki when you need to occupy in 2 years.

The Reality: Without proper infrastructure and amenities, you’ll face frustration and potentially sell at a loss before appreciation materializes.

The Solution: Match location to timeline:

- 0-2 years: Lekki only

- 2-5 years: Lekki or Ajah

- 5-10+ years: All three viable

Mistake #3: Skipping Professional Due Diligence

The Error: “My cousin knows someone selling cheap land in Ibeju-Lekki.”

The Reality: According to our due diligence data, 31 of 207 evaluated properties (15%) had issues preventing purchase – highest concentration in Ibeju-Lekki (22%).

The Solution: Always conduct professional verification through SCUML-registered brokers regardless of location in the Lekki vs Ajah vs Ibeju-Lekki comparison. Our verification process has saved clients ₦430M+ in prevented losses. Learn to identify common warning signs in our comprehensive guide on land scams in Lekki, which covers fraud patterns across the entire Lekki vs Ajah vs Ibeju-Lekki spectrum.

For a comprehensive checklist, review our guide on how to verify land documents in Lagos.

Mistake #4: Overlooking Total Cost of Ownership

The Error: Comparing a ₦30M Ajah plot to a ₦20M Ibeju-Lekki plot on purchase price alone.

The Reality:

- Ajah Plot: ₦30M + ₦2M (title perfection) + ₦1.5M (fencing) + ₦800K (access road contribution) = ₦34.3M total

- Ibeju-Lekki Plot: ₦20M + ₦3M (title perfection) + ₦3M (fencing) + ₦2M (access road) + ₦1.5M (borehole) = ₦29.5M total

Ibeju-Lekki’s lower purchase price can be offset by higher development costs, narrowing the Lekki vs Ajah vs Ibeju-Lekki price differential.

The Solution: Request total cost analysis from your broker showing all acquisition and development expenses. We provide this automatically in our consultation service.

For detailed cost breakdowns, see our guide on the cost of buying property in Lekki.

Mistake #5: Buying Without Market Comparison

The Error: Accepting the first quote without comparing alternatives across the Lekki vs Ajah vs Ibeju-Lekki spectrum.

The Reality: Many diaspora investors overpay 20-40% because sellers perceive them as less informed.

The Solution: Work with professionals who provide comparative market analysis across all three locations, showing you opportunity cost of each decision.

Example: A client had ₦60M budget and was considering:

- Option A: Lekki Phase 2 (300sqm plot for ₦60M)

- Option B: Ajah (500sqm plot for ₦40M) + Ibeju-Lekki (500sqm plot for ₦20M)

We ran 5-year projections showing Option B would likely yield ₦220M total value versus ₦100M for Option A – despite identical initial investment.

This is the power of professional guidance in navigating the Lekki vs Ajah vs Ibeju-Lekki decision. Book a consultation for your personalized comparison analysis.

Why Work with ATLAS REALTORS for Your Lekki vs Ajah vs Ibeju-Lekki Decision?

Expert Guidance Across All Three Corridors

As a SCUML-registered real estate brokerage, ATLAS REAL ESTATE BROKER LTD brings unique advantages to your Lekki vs Ajah vs Ibeju-Lekki investment decision:

Multi-Location Expertise:

- 50+ successful transactions across all three corridors

- Daily market monitoring in Lekki, Ajah, and Ibeju-Lekki

- Exclusive off-market listings in all locations

- Infrastructure development tracking and impact analysis

Unbiased Location Guidance: Unlike single-location developers, we have no vested interest in steering you to any particular area. Our only goal is matching the right location to your specific profile, budget, and timeline in the Lekki vs Ajah vs Ibeju-Lekki comparison. Learn more about our professional approach on our real estate broker in Lekki Lagos page, where we detail how we help clients navigate the Lekki vs Ajah vs Ibeju-Lekki decision objectively.

Comprehensive Services:

- Location Assessment:

- Investment goals analysis

- Budget optimization across locations

- Timeline matching

- Risk tolerance evaluation

- Property Identification:

- Curated listings in your target location(s)

- Micro-location analysis within Lekki, Ajah, or Ibeju-Lekki

- Video inspections with drone footage

- Infrastructure proximity mapping

- Due Diligence:

- Title verification at Lagos State Land Registry

- Survey authentication

- Community/family ownership validation

- Legal review by qualified property lawyers

- Comprehensive verification process

- Transaction Management:

- Price negotiation (average savings: ₦4.2M per transaction)

- Documentation preparation

- Secure payment coordination

- Governor’s Consent application

- Post-Purchase Support:

- Property development consultation

- Construction monitoring for overseas clients

- Resale assistance when needed

Success Metrics:

- 96% Remote Purchase Success Rate: Diaspora clients completing without traveling

- Zero Disputed Purchases: Every transaction backed by our due diligence

- ₦430M+ in Prevented Losses: Issues caught before purchase

- ₦4.2M Average Client Savings: Through expert negotiation

Regulatory Compliance:

- Company: ATLAS REAL ESTATE BROKER LTD

- RC Number: [Your RC Number]

- SCUML Registration: Fully compliant

- Professional Memberships: NIESV affiliates

Our SCUML registration means you have regulatory recourse and verified professional standards – critical when making large investment decisions in the Lekki vs Ajah vs Ibeju-Lekki comparison.

Get Started:

Ready to make your Lekki vs Ajah vs Ibeju-Lekki decision with confidence?

📞 Phone/WhatsApp: +234 806 724 2943 / +234 805 033 0264

📧 Email: info@atlsrealtors.com

🌐 Website: www.atlsrealtors.com

📍 Office: Aja, Lagos 106104, Lagos, Nigeria

Book Your Free 30-Minute Consultation

Explore our additional resources:

Frequently Asked Questions: Lekki vs Ajah vs Ibeju-Lekki

FAQ 1: Which is better for diaspora investors - Lekki, Ajah, or Ibeju-Lekki?

The optimal choice in the Lekki vs Ajah vs Ibeju-Lekki comparison depends on your specific circumstances:

Choose Lekki if: You plan to occupy within 1-2 years, prioritize lifestyle, have a budget above ₦400M, and accept moderate (8-15%) annual appreciation.

Choose Ajah if: You want balance between lifestyle and ROI, have a ₦20M-300M budget, plan 3-5 year timeline, and seek 20-35% annual appreciation with developing amenities.

Choose Ibeju-Lekki if: You’re land banking long-term (7-10+ years), prioritize maximum ROI (35-60%+ annually) over current lifestyle, have patience for infrastructure development, and budget ₦8M-45M.

For Most Diaspora Investors: Ajah often represents the “Goldilocks zone” in the Lekki vs Ajah vs Ibeju-Lekki comparison – not too expensive, not too remote, with strong appreciation potential and reasonable lifestyle amenities.

Our Nigerian Diaspora specialists have facilitated 50+ overseas transactions across all three locations. Book a consultation to discuss your specific situation.

For comprehensive diaspora buying guidance, read our guide on Lagos real estate investment from abroad.

FAQ 2: How do property prices compare in Lekki vs Ajah vs Ibeju-Lekki?

January 2026 Price Ranges (per square meter):

Lekki:

- Phase 1: ₦1.2M – ₦2.5M per sqm

- Phase 2: ₦800K – ₦1.5M per sqm

Ajah:

- Abraham Adesanya: ₦200K – ₦600K per sqm

- Sangotedo/Awoyaya: ₦40K – ₦120K per sqm

- Lakowe (estates): ₦100K – ₦300K per sqm

Ibeju-Lekki:

- Eleranigbe: ₦30K – ₦90K per sqm

- Bogije: ₦15K – ₦50K per sqm

- Serviced estates: ₦90K – ₦180K per sqm

Price Differential Example (500sqm plot):

- Lekki Phase 1: ₦600M – ₦1.25B

- Ajah (Abraham Adesanya): ₦100M – ₦300M

- Ibeju-Lekki (Eleranigbe): ₦15M – ₦45M

The Lekki vs Ajah vs Ibeju-Lekki price comparison shows a 10-40x differential between lowest and highest options – creating opportunities across all budget levels.

For comprehensive current pricing, see our detailed guide on land prices in Lekki Lagos.

FAQ 3: Which location will appreciate fastest between 2026-2030?

Based on our Lagos Real Estate Realtor analysis and infrastructure timelines:

Projected Annual Appreciation (2026-2030):

Lekki: 8-15%

- Mature market with steady, predictable growth

- Limited dramatic upside but very low risk

- Best for wealth preservation

Ajah: 20-35%

- Sweet spot with Fourth Mainland Bridge impact (2028-2029)

- Infrastructure improvements ongoing

- Balanced risk-reward profile

Ibeju-Lekki: 35-60%+

- Highest appreciation potential

- Infrastructure revolution nearing completion (2026-2028)

- Higher risk but explosive returns

Critical Caveat: These are area-wide averages. Micro-location selection within each area of the Lekki vs Ajah vs Ibeju-Lekki spectrum dramatically impacts actual returns. A well-selected Ibeju-Lekki plot could appreciate 100%+ annually, while a poorly-selected Ajah plot might see only 10%. This variance makes location-specific analysis crucial in the Lekki vs Ajah vs Ibeju-Lekki decision.

This is where professional broker guidance provides maximum value in the Lekki vs Ajah vs Ibeju-Lekki decision. Our infrastructure analysis team tracks development timelines and identifies highest-potential micro-locations across the entire Lekki vs Ajah vs Ibeju-Lekki corridor.

Book a consultation for detailed appreciation projections on specific properties you’re considering in your Lekki vs Ajah vs Ibeju-Lekki evaluation.

For insights on identifying high-growth areas within each location of the Lekki vs Ajah vs Ibeju-Lekki comparison, explore our detailed analysis on the best areas to invest in Lekki.

FAQ 4: Is it safe to buy land in Ibeju-Lekki as a diaspora investor?

Yes, but with critical caveats in the Lekki vs Ajah vs Ibeju-Lekki safety comparison:

Ibeju-Lekki Specific Risks:

- Higher incidence of title disputes (18-22% according to PropertyPro data)

- Traditional landowner (Omo Onile) issues more common

- Less mature title documentation than Lekki

- Longer due diligence requirements (30-45 days vs 14-21 days in Lekki)

Risk Mitigation Strategies:

- Work with SCUML-Registered Brokers: Professional verification reduces risk by 90%+. Our due diligence process has caught 22% of Ibeju-Lekki properties with preventing issues.

- Prioritize Government-Approved Titles: Government excision or C of O significantly reduces Omo Onile risk. Avoid family/community-only titles unless you have strong local knowledge.

- Focus on Established Areas: Eleranigbe, Beechwood Estate, Lakowe proximity areas have lower dispute rates than remote interior locations.

- Verify Infrastructure Access: Ensure property is within 3km of Lekki-Epe Expressway or major access roads.

- Budget for Legal Protection: Comprehensive title perfection (₦2-4M) provides maximum security.

Success Rate: 96% of ATLAS REALTORS diaspora clients complete Ibeju-Lekki purchases successfully using our verification protocols.

Bottom Line: Ibeju-Lekki is safe with proper professional guidance, but attempting DIY or working with unregistered agents significantly increases risk in the Lekki vs Ajah vs Ibeju-Lekki comparison. The risk profile differs across the Lekki vs Ajah vs Ibeju-Lekki spectrum, with Ibeju-Lekki requiring the most rigorous verification.

Book a consultation to discuss specific Ibeju-Lekki properties you’re considering. We’ll provide candid risk assessment and verification recommendations for your Lekki vs Ajah vs Ibeju-Lekki options.

Learn to identify warning signs across all three locations in our comprehensive guide on land scams in Lekki (many scam principles apply throughout the Lekki vs Ajah vs Ibeju-Lekki corridor).

FAQ 5: Can I get a mortgage to buy property in Lekki, Ajah, or Ibeju-Lekki?

Yes, but availability and terms vary significantly in the Lekki vs Ajah vs Ibeju-Lekki comparison:

Mortgage Availability by Location:

Lekki:

- Best mortgage access – most banks comfortable lending

- Typical LTV: 60-70% for completed properties, 40-50% for land

- Interest Rates: 18-25% annually

- Requires perfected title (C of O or clear excision)

Ajah:

- Moderate mortgage access – most major banks will consider

- Typical LTV: 50-60% for properties, 30-40% for land

- Interest Rates: 19-26% annually

- Requires verified excision minimum

- Some banks exclude certain Ajah sub-locations

Ibeju-Lekki:

- Limited mortgage access – few banks willing to lend on land

- Typical LTV: 40-50% maximum (land usually excluded)

- Interest Rates: 21-28% annually

- Usually requires C of O in established estate

- Most banks exclude Ibeju-Lekki for land-only purchases

Diaspora-Specific Options:

- Nigerian Bank Diaspora Programs:

- Stanbic IBTC Diaspora Home Ownership Scheme

- Access Bank Diaspora Housing Program

- GTBank International Remittance Mortgage

- Typically require Nigerian income or significant asset backing

- Family Homes Fund (FHF):

- 6% interest for land + construction packages

- Requires construction within 18 months

- Income limits apply (max ₦15M annually)

- Developer Financing:

- Some estate developers offer 12-24 month payment plans

- Interest-free or low interest (8-12%)

- Available in select developments across all locations

Practical Reality: Most diaspora investors in the Lekki vs Ajah vs Ibeju-Lekki comparison buy cash due to:

- High Nigerian interest rates (18-28% vs 5-10% abroad)

- Simpler transaction process

- Stronger negotiation leverage (5-10% cash discount possible)

Recommendation: If possible, secure financing in your country of residence at lower rates (5-10%), convert to Naira, and buy cash in Nigeria.

Need help navigating diaspora financing? Book a consultation to connect with our financial advisory partners who specialize in international property financing.

For comprehensive financing strategies, read our guide on Lagos real estate investment from abroad.

Making the Right Choice in Lekki vs Ajah vs Ibeju-Lekki

The Lekki vs Ajah vs Ibeju-Lekki decision is not about finding a universal “best” location – it’s about identifying which area aligns perfectly with your unique investment profile, timeline, budget, and lifestyle requirements.

Key Takeaways:

- Lekki offers immediate gratification, premium lifestyle, and stable appreciation (8-15% annually) at premium prices (₦800K-2.5M per sqm). Choose this for 1-2 year timelines, luxury living priorities, and ₦400M+ budgets.

- Ajah provides the sweet spot between lifestyle and ROI, with good amenities, strong appreciation (20-35% annually), and mid-market pricing (₦150K-600K per sqm). Ideal for 3-5 year timelines, family-oriented buyers, and ₦20M-300M budgets.

- Ibeju-Lekki delivers maximum ROI potential (35-60%+ annually) at lowest entry costs (₦15K-90K per sqm) but requires patience for infrastructure maturation. Best for 7-10+ year timelines, land banking strategies, and ₦8M-45M budgets.

Strategic Insights:

The Lekki vs Ajah vs Ibeju-Lekki landscape is transforming rapidly through 2026-2030. The Fourth Mainland Bridge (2028-2029) will elevate Ajah significantly, while the Lagos-Calabar Coastal Highway and Lekki International Airport (2027-2028) will mainstream Ibeju-Lekki. Early investors in strategic locations within Ajah and Ibeju-Lekki stand to capture the greatest value as these areas “Lekki-fy” over the next 3-5 years.

Your Next Steps:

Don’t make this critical decision in isolation. The difference between a successful investment and a costly mistake often comes down to three factors:

- Professional Location Matching: Aligning your profile with the right area

- Micro-Location Selection: Choosing the highest-potential spots within your target area

- Comprehensive Due Diligence: Protecting your investment through rigorous verification

At ATLAS Realtors, we’ve guided 50+ investors through the Lekki vs Ajah vs Ibeju-Lekki decision with a 96% satisfaction rate and zero disputed purchases.

Ready to Make Your Decision?

📞 Call/WhatsApp: +234 806 724 2943 / +234 805 033 0264

📧 Email: info@atlsrealtors.com

🌐 Website: www.atlsrealtors.com

📅 Schedule Your Free Consultation

Our consultation service includes:

- Investment profile assessment

- Budget optimization analysis

- Location recommendation with rationale

- Curated property shortlist (if desired)

- ROI projections for your specific scenario

- Risk assessment and mitigation strategies

Time-Sensitive Note: Properties in high-growth corridors (particularly Ajah and strategic Ibeju-Lekki locations) are being acquired daily by informed investors. The earlier you enter these markets relative to infrastructure completion, the greater your potential returns.

However, don’t let urgency override caution. Strategic speed with professional guidance beats rushed decisions every time.

Make your Lekki vs Ajah vs Ibeju-Lekki choice with confidence. Book your consultation today.

Choose wisely. Invest professionally. Build generational wealth.

Related Resources: Deepen Your Lagos Real Estate Knowledge

Essential Reading Before Your Investment

Continue your research with these comprehensive guides from ATLAS REALTORS:

Core Resource: Our Main Service Page

Real Estate Broker in Lekki Lagos – Your complete resource for understanding professional brokerage services across Lekki, Ajah, and Ibeju-Lekki. Learn about our SCUML registration, verification processes, and why professional guidance is essential for the Lekki vs Ajah vs Ibeju-Lekki decision.

Complementary Cluster Posts

These articles form a complete knowledge framework with this Lekki vs Ajah vs Ibeju-Lekki comparison:

- Land Prices in Lekki Lagos (2026 Price Guide) – Detailed pricing analysis covering all locations discussed in this comparison. Essential for understanding the exact cost differentials in the Lekki vs Ajah vs Ibeju-Lekki decision with location-by-location breakdowns.

- Land Scams in Lekki: 5 Red Flags to Avoid – Critical protection guide showing common fraud patterns across all three locations. Learn to spot fake documents, Omo Onile schemes, and inflated prices that target diaspora investors.

- How to Verify Land Documents in Lagos – Step-by-step verification process for C of O, excision, and survey plans. Essential reading before purchasing in any location from the Lekki vs Ajah vs Ibeju-Lekki spectrum.

- Best Areas to Invest in Lekki for Maximum ROI – Micro-location analysis within each corridor showing which specific neighborhoods offer the highest appreciation potential. Complements this Lekki vs Ajah vs Ibeju-Lekki overview with granular detail.

Buyer's Guides

5. How to Buy Land in Nigeria from Abroad – Complete remote purchase process for diaspora investors buying in Lekki, Ajah, or Ibeju-Lekki. Covers payment methods, legal requirements, and video inspection protocols.

6. Cost of Buying Property in Lekki – Total cost analysis beyond purchase price including legal fees, title perfection, and development costs across the Lekki vs Ajah vs Ibeju-Lekki locations.

7. Lagos Real Estate Investment from Abroad – Strategic investment framework for diaspora Nigerians covering financing, currency management, and ROI expectations in all three corridors.

Professional Services

- Find a Realtor in Lagos – How to select qualified professionals when making your Lekki vs Ajah vs Ibeju-Lekki investment decision. Red flags to avoid and questions to ask.

- Lagos Real Estate Agent Services – Understanding agent vs broker differences and maximizing value from professional representation across all locations.

Due Diligence & Risk Management

Lagos Real Estate Due Diligence Process – ⭐ CRITICAL READ – Our comprehensive 15-point verification system that has saved clients ₦430M+ in prevented losses across Lekki, Ajah, and Ibeju-Lekki.

Additional Resources

- Nigerian Diaspora Real Estate Services – Specialized support for overseas investors navigating the Lekki vs Ajah vs Ibeju-Lekki decision remotely.

- Best Real Estate Companies in Lagos – Comparative analysis of top firms serving the Lekki corridor.

- Trusted Realtors in Lagos – What makes ATLAS REAL ESTATE BROKER LTD a reliable partner for your Lekki vs Ajah vs Ibeju-Lekki investment.

- Real Estate Broker in Ikeja Lagos – Considering Mainland alternatives? Compare Ikeja opportunities against the Lekki vs Ajah vs Ibeju-Lekki options.

- Contact ATLAS Realtors – Multiple ways to reach our team for personalized Lekki vs Ajah vs Ibeju-Lekki guidance.

Stay Updated

Visit our Blog for weekly market updates, new listings, infrastructure development news, and ongoing Lekki vs Ajah vs Ibeju-Lekki market analysis.

Ready to Move Forward?

You now have comprehensive knowledge for making your Lekki vs Ajah vs Ibeju-Lekki decision. The next step is applying this framework to your specific situation with professional guidance.

Schedule Your Free Consultation | Call: +234 806 724 2943 | Email: info@atlsrealtors.com